PROCESSING

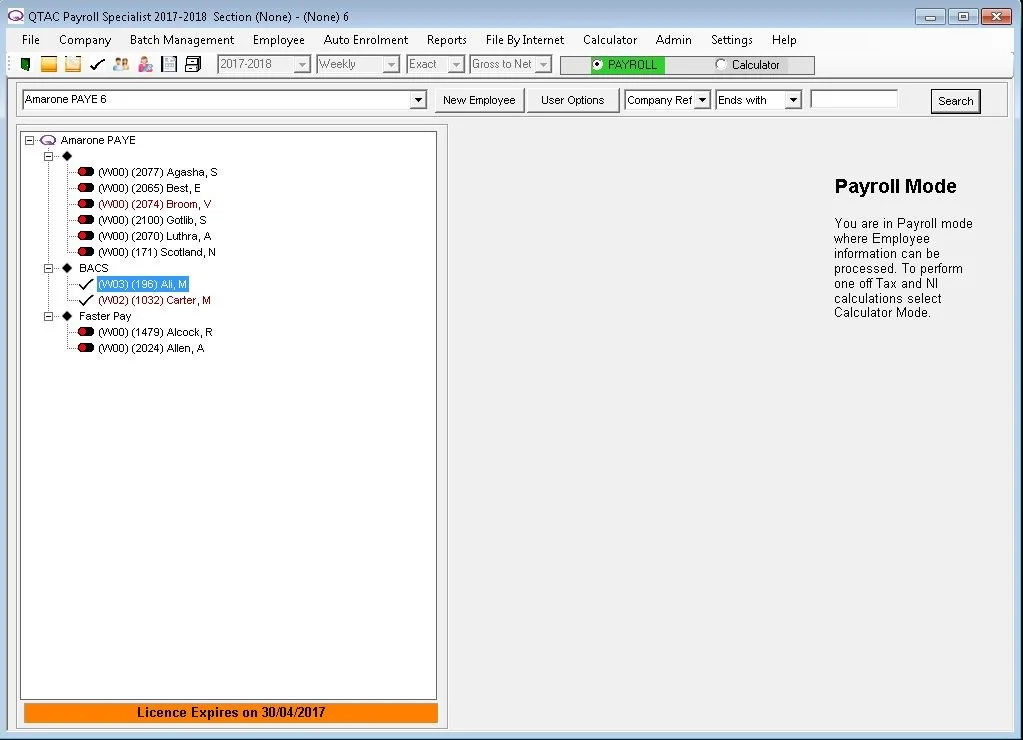

We use the HMRC Accredited award winning payroll from the Bristol based payroll software provider QTAC as our payroll engine. We have worked with them over time to alter their software to deal with Umbrella calculations. The flexibility of setup enables us to support all different Umbrella, CIS and PAYE setups and for QTAC to concentrate on payroll and for us to concentrate on BackOffice and the Portals

All the basic work is completed in BackOffice; completing timesheets and expenses; applying to invoices; marking the invoices or individual lines as paid; and then pushing the pay record to QTAC. There is a simple update routine to process the payroll into QTAC and close the pay period. Once that is complete, then it is back to BackOffice to run payslips, run text queues, create BACS files and run reports

QTAC completes the actual tax calculation, but is is also where you complete Tax Code changes, setup Attachment of Earnings, set Auto Enrolment Pensions, verify CIS records and run RTI and P32 reports and processes