RTI

Real Time Information (RTI) covers sending company and employee payment details to HMRC. The Full Payment Submission (FPS) is the submission you make each pay period. Occasionally you will send an Employer Payment Summary (EPS) when you recover statutory payments, of it you need to include supplementary information about your company’s tax and NI liability, such as employment allowance and small employers’ relief.

All these processes are completed in QTAC

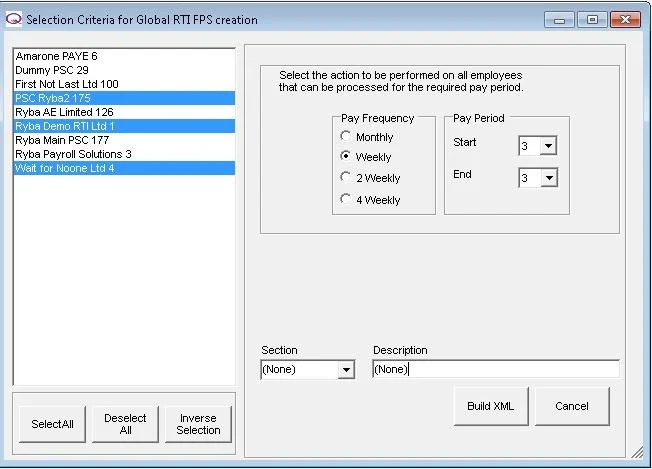

You can schedule your RTI submissions to send out of office hours; you can set QTAC to send the details automatically; you can send the details for one contractor individually; you can bulk create multiple RTI submissions in one process. There are a lot of options, but all of them are there to support how you do business. Once your FPS has been received and accepted by HMRC. QTAC will display a ‘Crown’ symbol over the Contractor pay period closed tick.

Whilst CIS Contractors are not formally part of the RTI process; there are options in QTAC to submit their monthly returns

Trusted Partner

Umbrella Software is your trusted business partner, helping companies across the UK by leading the way in commercial program portals.

We manage your office framework, giving you more time to focus on expanding and building your products and services.

Free Demo

Experience the power of Umbrella Software with a free demo, and see how we can transform your business operations.